How an overseas investor helped people facing homelessness

By listing properties on our specialist portal, the owner was able to find a care provider to take his properties on a long lease

Read the case study >One of the subjects we talk about a lot on our Supported Living Strategy Course is the need for multiple exit strategies. After completing the training, Ant and Bex Wells, owners of property investment company A B Wells Projects, went on to put the theory into practice by listing their loss-making HMO on our property portal.

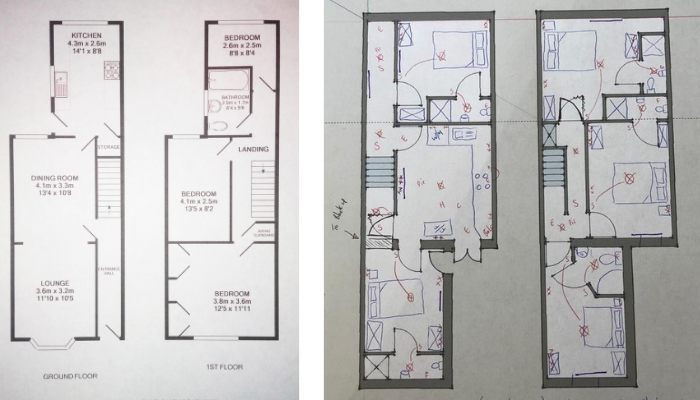

Ant and Bex purchased a 3-bed house in Doncaster and added value to the property by converting it into a 5-bed HMO. As you can see from the floor plans, this was achieved by converting the kitchen and lounge into bedrooms and the dining room into a kitchen. The family bathroom was taken away and en-suites were added to every bedroom. The property was also renovated throughout and A B Wells set up a classic HMO.

The dated property was also renovated to a high standard throughout and A B Wells set up an attractive HMO. This looked like a great investment and they were expecting to make a nice profit if the property was fully occupied but sadly ran into problems. Instead of achieving the £753pm they were anticipating, they made a loss of £168pm.

Purchase price: £72K

Refurb, fees and finance: £50K

GDV: £160K

Mortgage: £120K

HMO rent if fully occupied: £2,166

Mortgage: £495

Bills, insurance, maintenance and management: £918

Net profit if fully occupied £753pm

Actual income 2020

Loss of £168pm

This sort of loss is a common problem with HMOs: the rental income can look really attractive but, in reality, a lot of that income gets eaten up by costs and voids. On top of that, the time taken to manage these properties can be really high.

As such, A B Wells began looking for an alternative strategy for the property. Whilst supporting living appealed, they found it difficult to connect with local providers until they discovered Supported Living Gateway on social media. By listing the property on the property portal, A B Wells were able to find a care provider who was interested in leasing it and whose values aligned with their own. The care provider in question supports individuals with learning difficulties and autism – this felt like a great fit for the business as owners Ant and Bex both have personal experience of family members with similar support needs. And so they refinanced the property; here are the numbers:

Refinance for supported living: £195K

New mortgage: £136.5K

Rent from care provider: £1,365pm

Mortgage 6.5%: £739pm

Insurance: £100

Profit: £526pm

The lease length agreed with the care provider was 5 years and, during that time, A B Wells will have no bills to worry about, no voids and no management hassles. The investment is effectively hands free and the net income is higher, despite higher financing costs and lower rental income. And, what’s more, A B Wells have been able to follow their dream of helping people who really need high-quality homes.

I love The Gateway, they’ve helped us to find a care provider for our property and build a relationship to move forward with our business model. They’ve been very informative with everything we need to know regarding legal issues and in keeping us up to date along the way. We thank them from the bottom of our hearts for all the hard work they’ve put in!

By listing properties on our specialist portal, the owner was able to find a care provider to take his properties on a long lease

Read the case study >

A young man with complex learning disabilities needed a home urgently after his placement had broken down.

Read the case study >